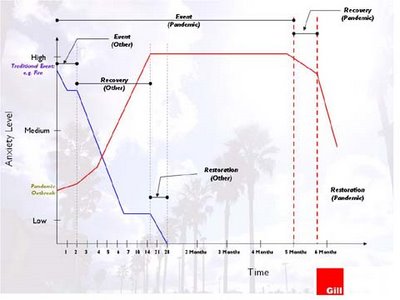

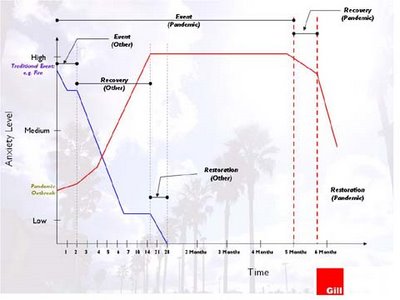

Structural Differences Between Avian Flu and Other Events

There's much discussion these days about how business should go about addressing avian flu, should a global pandemic break out. More often than not, business continuity planners continue to lump avian flu with a number of other events of mass disruption. I think, however, that avian flu should be approached differently. In fact the dynamics of avian flu are completely different than the dynamics of most other events, regardless of their impact. Consider the following illustration:

This chart shows that avian flu differentiates itself from an other type of event based upon two criteria: event duration (whereas other events can unfold in a moment or a day, allowing recovery to take place when the event is over, the duration of an event such as avian flu can continue for weeks or months; receovery cannot take place until after the event is over), and the way in which anxiety levels of people which are usually at their highest point during a more "traditional" event and gradually decrease over time will actually increase over time.

The chart is fairly self-explanatory. Take a look at it and make sure your planners understand this dynamic and calibrate their planning strategies accordingly.

This chart shows that avian flu differentiates itself from an other type of event based upon two criteria: event duration (whereas other events can unfold in a moment or a day, allowing recovery to take place when the event is over, the duration of an event such as avian flu can continue for weeks or months; receovery cannot take place until after the event is over), and the way in which anxiety levels of people which are usually at their highest point during a more "traditional" event and gradually decrease over time will actually increase over time.

The chart is fairly self-explanatory. Take a look at it and make sure your planners understand this dynamic and calibrate their planning strategies accordingly.